Learning Track Quantitative Approach In Options Trading

$670.00 Original price was: $670.00.$82.00Current price is: $82.00.

An 8-course learning track to start using quantitative techniques in Options Trading. Learn to create pricing models, various Options Trading strategies like Arbitrage Strategy, Box Strategy and Calendar Spread.

- Description

- Reviews (0)

- More Products

Description

Learning Track Quantitative Approach in Options Trading

An 8-course learning track to start using quantitative techniques in Options Trading. Learn to create pricing models, various Options Trading strategies like Arbitrage Strategy, Box Strategy and Calendar Spread. Use ARIMA-GARCH models, Machine Learning techniques and Mean Reversion strategies in Options Trading.

SKILLS COVERED

Options Trading

- Index Arbitrage

- Mean Reversion

- Delta Trading

- Box Trading

- Dispersion Trading

Math & Core Concepts

- ARIMA-GARCH

- Option Pricing and Greeks

- Put Call Parity

- Volatility Smile and Skew

- Exotic Options

Python Libraries

- NumPy

- Pandas

- Scikit-learn

- TA-Lib

- Support Vector Classifier

COURSE FEATURES

- Lifetime Access to the course

- Community support

- Downloadable codes

- Hands-on guided learning

- Get Certified

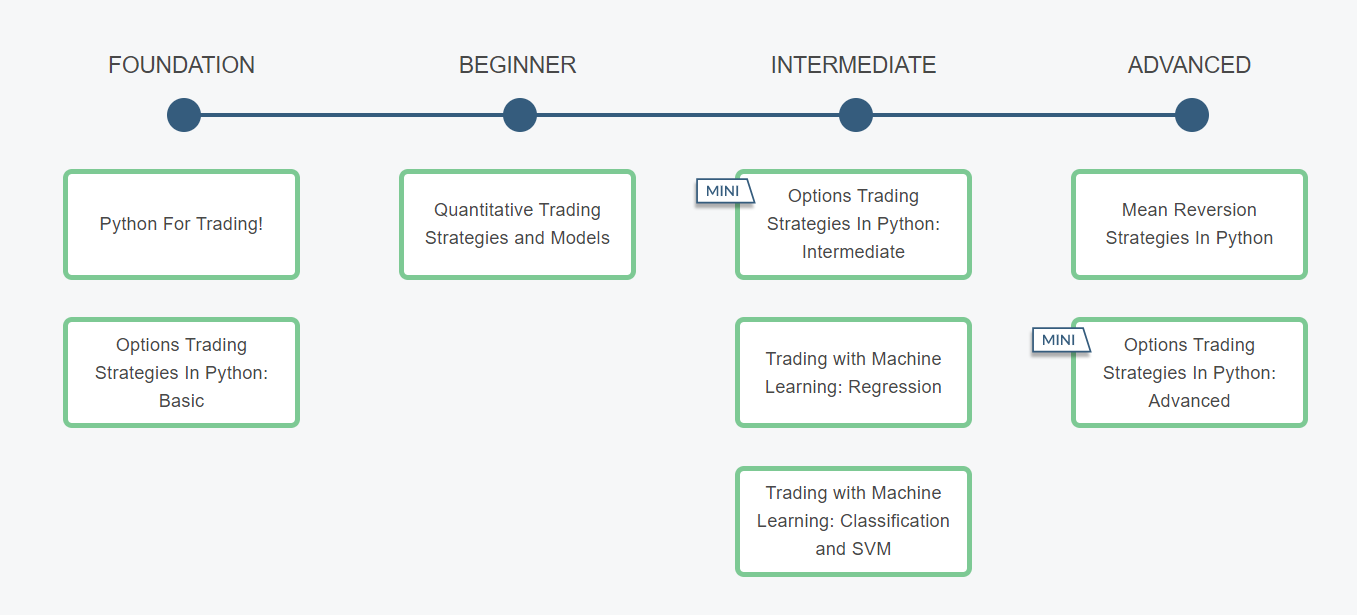

LEARNING TRACK

Quantitative Approach in Options Trading

PREREQUISITES

It is expected that you have some financial markets experience and understand terms like sell, buy, margin, entry, exit positions. Some familiarity with options and technical indicators might help you in better understanding the concepts. The track covers basics of Python for trading, which will help you understand and learn the essential coding knowledge required to replicate the models in your trading.

AFTER THIS COURSE YOU’LL BE ABLE TO

Create option pricing models including BSM, Derman-Kani Model and Heston Model. Use options pricing techniques using 2nd, 3rd, 4th order Greeks to create trading strategies.

Create various types of Options trading strategies which are used by Hedge Funds and individual retail traders such as Arbitrage Strategy, Calendar Spread Strategy, Earnings Strategy, Box Trading, strategies based on implied volatility.

Compute valuation using various exotic and compound options such as Binary options, Barrier options, Chooser options, Gap options and Shout options.

Learn to manage risk by implementation of dynamic hedging using Greeks like Delta Neutral Portfolio and Gamma Scalping

Use computational powers and mathematical concepts in options trading. Create a trading strategy using Decision Tree Classifier. Explain concepts like Binomial Trees, Wiener Process, and Ito’s Lemma, and how they are used for the derivation of Black Scholes Merton model.

Specialize in Quantitative Options Portfolio Management by getting trained in practical and implementable course content created by successful Options traders with over 30 years of combined experience of algorithmic trading in Options segment.

SYLLABUS

Course 1: Python For Trading!

- Introduction to Python!

- Python Data Structures

- Data Analysis & Trading

- Dealing with Financial Data

- Backtesting

- Performance Metrics

- Python Installation and Automated Execution

Course 2: Options Trading Strategies In Python: Basic

- Know your Options!

- Options Nomenclature

- Types of Volatility

- Options Trading Strategies

- Python Installation and Automated Execution

- Wrapping Up!

Course 3: Quantitative Trading Strategies and Models

- Quantitative Trading: An Introduction

- Technical Trading Strategies

- Econometric Models

- Quantitative Trading Strategies for Options

- Python Installation and Automated Execution

- Summary

Course 4: Options Trading Strategies In Python: Intermediate

- Options Pricing Models

- Evolved Options Pricing Model

- Options Greeks

- Options Trading Strategies

- Volatility Trading Strategies

- Python Installation and Automated Execution

- Wrapping Up!

Course 5: Trading with Machine Learning: Regression

- Problem Statement

- Introduction to Data Generation

- Data Pre-Processing

- Regression

- Bias and Variance

- Applying the Prediction

- Creating the Algorithm

- Python Installation and Automated Execution

- Downloadable Code

Course 6: Trading with Machine Learning: Classification and SVM

- Introduction

- Binary Classification

- Multiclass Classification

- Support Vector Machine

- Prediction and Strategy

- Python Installation and Automated Execution

- Downloadable Code

Course 7: Mean Reversion Strategies In Python

- Stationarity of Time Series

- Cointegration

- Triplets

- Half Life

- Risk Management

- Best Markets to Pair Trade

- Index Arbitrage

- Long Short Portfolio

- Python Installation and Automated Execution

- Summary

Course 8: Options Trading Strategies In Python: Advanced

- Mathematical Models for Options Trading

- Dispersion Trading

- Machine Learning

- Exotic Options

- Risk Management

- Scenario Analysis

- Python Installation and Automated Execution

- Summary

Learning Track Quantitative Approach In Options Trading on sensecourse.info

Be the first to review “Learning Track Quantitative Approach In Options Trading” Cancel reply

You must be logged in to post a review.

-

Surge Sounds Melodic Dubstep WAV MiDi Synth Presets

0 out of 5$45.00Original price was: $45.00.$17.00Current price is: $17.00. Buy now -

-

David Deida – For Couples: Going Deeper Into Your Love

0 out of 5$54.00Original price was: $54.00.$22.00Current price is: $22.00. Buy now -

The Social Man – Dating Power

0 out of 5$50.00Original price was: $50.00.$20.00Current price is: $20.00. Buy now -

Psychedelica – Gaia

0 out of 5$299.00Original price was: $299.00.$52.00Current price is: $52.00. Buy now -

Jonette Crowley – Soul Body Fusion

0 out of 5$533.00Original price was: $533.00.$52.00Current price is: $52.00. Buy now

You may also like…

-

7 Weeks To Cash – Ignite Your Prosperity 2017 Version

0 out of 5$3,997.00Original price was: $3,997.00.$142.00Current price is: $142.00. Buy now -

Aaron Fletcher – The Fletcher Method

0 out of 5$997.00Original price was: $997.00.$44.95Current price is: $44.95. Buy now -

[BIG Collection Real Estate] Real Estate Web Academy – Great Real Estate Giveaway

0 out of 5$999.00Original price was: $999.00.$92.00Current price is: $92.00. Buy now -

Aaron Ross – Predictable Revenue The Ultimate “Cold Calling 2.0″ Course & Library

0 out of 5$2,500.00Original price was: $2,500.00.$142.00Current price is: $142.00. Buy now

Reviews

There are no reviews yet.