James Pollard – Your First Year As A Financial Advisor

Original price was: $49.00.$24.00Current price is: $24.00.

Here’s even more good news… as a financial advisor, you can make your own hours and set your own vacation schedule. And while you may have a manager, you’ll never really have a “boss” in the sense of having someone order you around.

- Description

- Reviews (0)

- More Products

Description

James Pollard – Your First Year As A Financial Advisor

Sale Page: https://www.theadvisorcoach.com/your-first-year.html

If you’re a new financial advisor, I’ve got good news and bad news…

The good news?

Well, first of all, congratulations on deciding to become an advisor.

Because according to publications such as U.S. News and World Report, it’s one of the best jobs in the country.

In fact, CNN Money ranked “Financial Advisor” as the #6 best job in America, beating out physical therapists, software developers, and even personal trainers.

Here’s even more good news… as a financial advisor, you can make your own hours and set your own vacation schedule. And while you may have a manager, you’ll never really have a “boss” in the sense of having someone order you around.

Plus, you can make as much money as you want. As a financial advisor, your life is what you make it… and you have a solid chance of achieving true financial independence by helping others.

Now for the bad news…

It can be so difficult to succeed that Investopedia calls financial advising a “high-stress industry” (which I think is the understatement of the year).

And depending on which study you read – anywhere from 80 to 95% of financial advisors fail in the first three years.

Fortunately, it doesn’t have to be that way.

Because here’s how you can tilt the odds in your favor.

Keep reading…

But First, Read This Disclaimer…

Please understand that my results are not typical. I’m not implying you’ll duplicate them (or do anything for that matter).

The average person who buys any “how to” information gets little to no results. As with all of my products, my references are used for example purposes only.

I’ve had years helping financial advisors and my personal results should be considered exceptional.

Your results will vary and depend on many factors… including but not limited to your background, experience, and work ethic.

All business entails risk as well as massive and consistent effort and action. If you’re not willing to accept that, please DO NOT GET THIS.

With that said… let me show you…

Exactly What You’re Getting…

This is a 124-minute MP3 audio download called “Your First Year as a Financial Advisor” and it will help you whether this is your first “real” job or you’re a career-changer taking on a new challenge.

After all, I’ve helped everyone from those fresh out of college to teachers, military veterans, and even attorneys make the leap to the financial services industry.

Which is why I’ve decided to compile some of my best advice, specifically for new advisors.

Here’s a small “sneak-peek” of what you’ll discover…

- Why seeking out a mentor is one of the worst things a new financial advisor can do. (And if you already have a mentor, I’ll share with you two pieces of advice you should never take from a mentor… no matter how successful the mentor is…)

- You should ask friends and family members to be your clients, right? Wrong! This is a terrible move and I’ll explain why.

- The 2 types of prospects you should avoid at all costs. Approach these prospects and they’re sure to waste your valuable time and energy.

- Why introverts often make the best financial advisors. (The financial advisor industry has a bias toward extroverts, yet I’ve found a few specific “introvert-friendly” qualities which almost always make an advisor successful.)

- How to justify your fees and immediately melt price resistance. (Frankly, if I only had ONE way to help financial advisors demonstrate their value, this would be it.)

- What to never do with your business card, and why. (If you get this wrong, prospects will laugh behind your back and you’ll never hear from them again.)

- How to leave voicemails that get returned. (This is what lets the world’s best salespeople make six or seven figures per year while everybody else gets their calls ignored.)

- How to properly handle the “I already have a financial advisor” objection. (If more financial advisors knew this, they would probably look for nothing BUT people who already have an advisor…)

- One critical mistake financial advisors make with their email subject lines which can decrease open rates up to 60%. (Unfortunately, most financial advisors are committing this “cardinal sin” of email marketing – and losing money every time they click “send” – without even knowing it.)

- A weird (but effective) way to follow up with your prospects which is nearly impossible to ignore. (Caution: this doesn’t work every time but when it does, it’s powerful stuff. Use sparingly.)

- The best day of the week to make cold calls. In fact, you are 49% more likely to reach someone on this day of the week than Tuesday, which is the worst day of the week to pick up the phone.

- What you should never put in your email signature. (Even experienced advisors make this costly mistake.)

- 2 things which immediately reveal your inexperience. (Let these two things slip through the cracks and you can kiss your potential clients goodbye.)

- The single most damaging prospecting “habit” nearly all new advisors have which virtually guarantees they will never build a great book of business. (Once you’re privy to this secret, the sky’s the limit.)

- Why qualifications and credentials do not matter. (Warning: this advice offends a lot of experienced advisors because it allows new advisors to blow them out of the water with ease.)

- How to overcome age bias – this applies to both younger and older financial advisors.

- Why the stupid “standard” advice about follow-up will get you ignored… and the only correct way to follow up with a prospect.

- Why cheesy sales tactics do NOT work with sophisticated investors… and what to do instead. (Cheesy sales tactics might work for selling widgets in the mall but it turns out there’s a much better way to “sell” financial services.)

- Hands down the most “newbie-friendly” way for financial advisors to build trust, authority, and credibility with prospects.

- 5 questions to ask during your prospect meetings which will immediately separate you from your competition and “prime” your prospect to do business with you. (By using this strategy, clients will spoon-feed you what they want and expect… it’s up to you to deliver.)

As you can see, there’s a lot of information here… and it’s only the tip of the iceberg…

Here’s How Much It “Costs”…

Which means it “costs” less than dinner and a movie. And I say “costs” because it really shouldn’t cost you anything – it should pay for itself again and again.

(Plus, it comes with a money-back guarantee, which is explained below.)

I even had debates about whether or not I should price it this low. I decided to do it for a few reasons…

Here’s Why It’s So Cheap…

As you may or may not know, I offer a wide variety of products and services for financial advisors, ranging from less than a hundred bucks to several thousand dollars for private coaching and consulting.

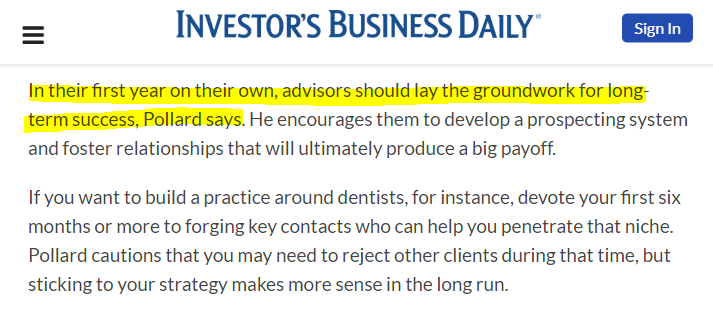

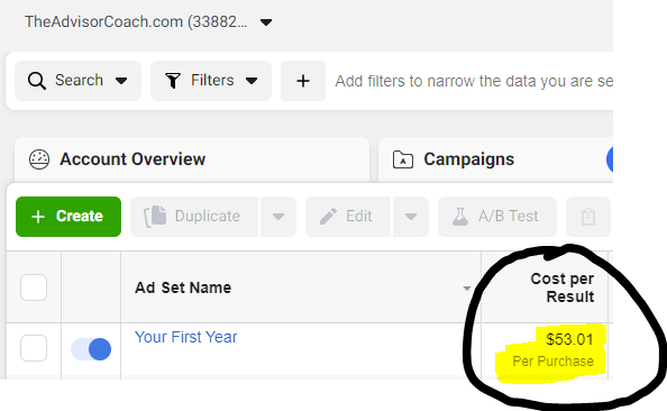

In most cases, I take a loss when I sell something at this price. Because it costs me just over $53 in advertising (on average) to sell one of these.

So, why would I do it?

Because new financial advisors are the ones who complain the most about how they “can’t afford” what I offer (like my $99 per-month newsletter) or how my services aren’t “in the budget”.

Well, $49 is low enough so anyone can afford it. And if you’re a new financial advisor who can’t be bothered to invest less than fifty bucks in yourself… well, maybe you should look for a new career.

However, don’t be fooled into thinking this isn’t valuable because I’ve priced it so low. If you’re someone who takes pride in getting a screaming good bargain, this is it.

My selfish reason for putting together this offer is to get you in my world. I want you to see that I’m the “real deal”.

Because once you do, you’ll see the benefits and purchase my other stuff as well. My thinking is maybe… just maybe… if I impress you with this overly-generous deal today, I can make a dollar profit from you later on when you come back for more. It’s worth a try, anyway.

To be completely candid, most financial advisors who purchase “Your First Year As A Financial Advisor” are so blown away that they go on to make several more purchases from me.

Be the first to review “James Pollard – Your First Year As A Financial Advisor”

You must be logged in to post a review.

-

Emily Tan – Residency Interview Prep Course

Original price was: $25.00.$10.00Current price is: $10.00. Buy now -

O’Reilly Media – Learn To Use Photoshop CC 2017

Original price was: $90.00.$35.00Current price is: $35.00. Buy now -

-

Reviews

There are no reviews yet.